New Delhi: Gold is considered a safe haven for investors who rely more on traditional investment instrument. The yellow metal has typically experienced notable fluctuations with upward trend in price during the Diwali festival, as it is a time when many people in India purchase gold for its auspiciousness.

The cultural significance of gold during Diwali ensures that there is a consistent level of demand. However, a deeper analysis reveals that the volatility observed during this period is largely driven by broader global macroeconomic factors rather than Diwali itself.

Amit Goel, Co-Founder and Chief Global Strategist at Pace 360 in an exclusive interview with Reema Sharma of Zee News shared the outlook on gold, how the yellow metal has fared in the last 10 years.

1. How much return has gold given in the last 10 years?

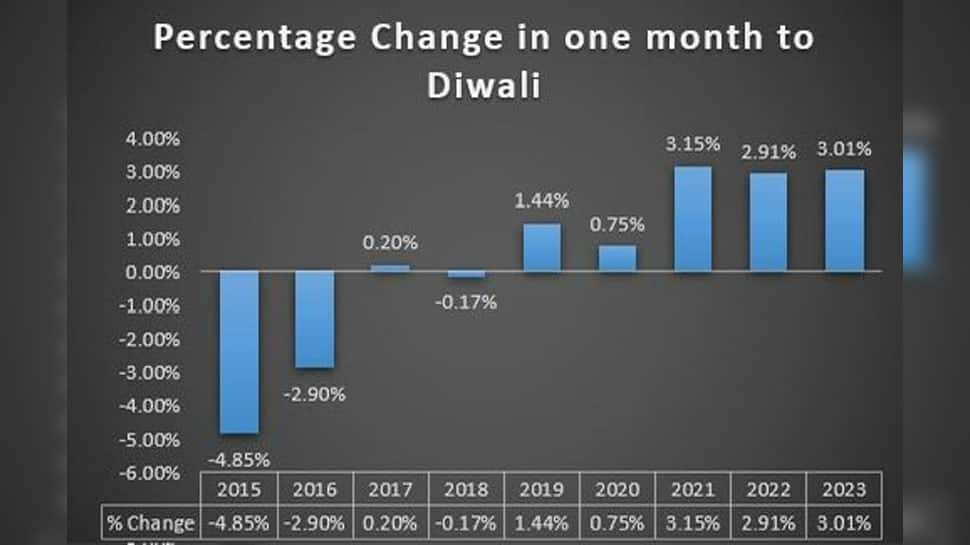

Gold has historically experienced sharp volatility in the pre-Diwali period. However, much of this is not because of Diwali but because of global macro factors. Over the last 10 years the average return in the one month to Diwali has been only mildly positive. Most of that positive return is because of last 3 years when gold moved up smartly in the run-up to Diwali.

In each of the last 3 years gold made a bottom between August and October and the bottom was made because of sharp rise in US bond yields and the Dollar index. Hence, a study of last 10 years indicates that Diwali is no longer a big influence on international gold prices and the same is impacted by huge asset classes like Global bond yields and the Dollar.

2. Is gold still a lucrative investment option, considering other saving instruments?

Gold can be a lucrative investment, depending on market conditions, inflation, and individual goals. It serves as a hedge against inflation by retaining value during price increases and acts as a safe haven during market volatility. Including gold in a portfolio helps diversify risk, as it typically shows low correlation with stocks and bonds. While alternative investments like stocks, bonds, real estate, and cryptocurrencies may offer higher returns as they come with different risks. Generally, gold is viewed as a better long-term investment, whereas stocks might yield higher short-term gains.

3. What is the outlook on gold for this fiscal?

Recent gold price rally is driven by geopolitical uncertainty and potential of further interest rate cuts. On the domestic front, demand for physical gold is expected to surge due to the fast-approaching Diwali and wedding season. We expect gold prices to subside over next few months as it is extremely overheated as an asset class before resuming their long-term bull run.

Stay informed on all the , real-time updates, and follow all the important headlines in and on Zee News.