Muhurat trading 2025: Muhurat trading, a feature unique to the Indian stock market, will take place on Tuesday, October 21, this year. This special one-hour trading session of the is held once every year on the occasion of Diwali.

As Diwali marks the onset of the new Hindu calendar year, or a Samvat, it is considered auspicious to do token trading on this day. Investors usually engage in this session to buy stocks for the long term as part of tradition.

How does market perform on Muhurat trading?

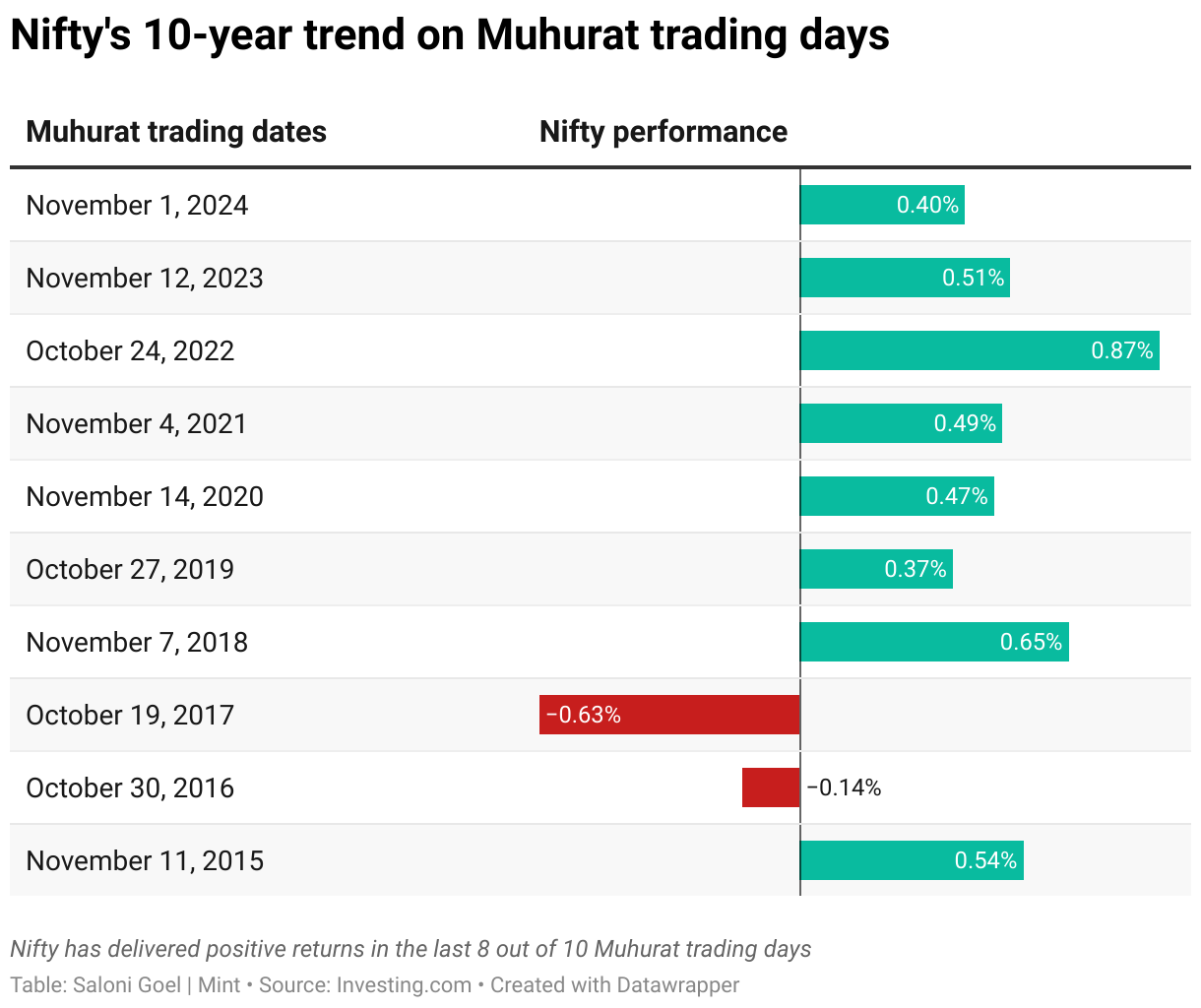

But does really promise returns for investors? According to the 10-year history, the benchmark index Nifty 50 has risen in eight sessions and lost in only two – signalling a positive trend during Muhurat trading days.

It was seven years ago, in 2017, that the Nifty 50 last delivered negative returns of 0.63%. Since then, the market trend has been a positive one. The average returns eked out by the index have been of 0.35%, with the highest return delivered in 2022, when the Indian stock market jumped nearly a per cent by 0.87%.

Trading volumes during Muhurat trading are generally low. However, all the trades executed during the Diwali Muhurat trading session result in settlement obligations for investors.

Diwali cheer on Dalal Street: Nifty gains 3% in 4 days

The signs of Diwali cheer are clearly visible in the Indian stock market in the run-up to the festival, with the Nifty 50 having risen for the fourth straight day today.

In the last four sessions (including today), Nifty 50 has added over 750 points or risen 3.09%.

According to Vishnu Kant Upadhyay, AVP -Research & Advisory, Master Capital Services, with a blend of supportive technical indicators and improving fundamentals, overall market sentiment remains optimistic.

What is the outlook for Samvat 2082?

As we usher into a new Samvat 2082, India stands at a defining point in its economic and market journey, marked by reform momentum, macro resilience, and a maturing domestic investor base, said Motilal Oswal Financial Services in a note recently.

“Samvat 2082 begins on a positive note, thanks to a combination of fiscal and monetary tailwinds. The RBI has cut the repo rate by 100 bps and CRR by 150 bps, together with several measures, injecting much-needed liquidity into the system. This, coupled with the income tax relief of ₹1 lakh crore, would aid demand revival and improved potential for corporate earnings. Inflation remains comfortably low while the GST 2.0 has simplified rates and revived consumer sentiment. We believe this marks the beginning of a turnaround in India’s domestic growth momentum, with a significant pick-up in consumption paving the way for a robust revival in the private capex cycle. This, along with the improving earnings trajectory, should lend support to Indian equities,” said the brokerage while commenting on the outlook for the next year.

According to Kant, the broader outlook for the Nifty 50 remains constructive, and the “buy-on-dips” strategy is likely to prevail. “Any corrective move towards the 25000–24800 zone could offer an opportunity to initiate fresh long positions, with initial upside targets placed around 25650–25700 levels,” he opined.

Disclaimer: This story is for educational purposes only. The views and recommendations expressed are those of individual analysts or broking firms, not Mint. We advise investors to consult with certified experts before making any investment decisions, as market conditions can change rapidly and circumstances may vary.